The Campaign Proposal for Kashi was done as a group project that consisted of five students. We each contributed

as a group as well as individually. The portion that I had done is italicized and in bold.

SWOT

Competition

Though there are many frozen pizza brands out there, Kashi Pizza’s most formidable opponents include DiGorno, Tombstone, Red Baron, and CPK frozen pizzas. With sales between the aforementioned companies varying according to the individual brands, competitors are spending between $4 million and $35 millions annually on advertising. DiGiorno utilizes their budget between Internet, Outdoor, Net and Spot TV, Cable and Magazine. Tombstone, CPK, and Red Baron use most of their budget on the Internet, Magazine, and TV. Most of the competition uses more than one market to advertise their products, where as Kashi only used Internet. That being said, by spreading our advertising budget out to other medium such as TV, Radio or Print advertisements, we can sweep in and be a force to our competitors.

Target Audience

After reviewing the data of households that consume frozen pizza, we found that female college graduates aged 25-54 make up a large majority of the pizza buying market. This makes sense considering women are the primary household spenders when it comes to groceries. Since child obesity is on the rise, families are becoming more responsive to the epidemic and purchasing healthier foods, like Kashi products, to feed to their families. Because the products are more expensive, we’ll be gearing them to families with a household income between 75,000-125,000. The Pacific, Northeast and West Central regions are more likely to buy natural/organic food.

Kashi Consumers’ Buying Habits

Since buying habits vary by socio-economic makeup, gender, education level, race and other extenuating factors, our consumers’ habits tend to be a more specific. Because our target audience is women with a higher level of education and household income, they tend to be more physically active by engaging in activities like yoga and Pilates. The individuals that participate in these types of exercises generally are concerned with eating food that is organic or whole wheat that is where Kashi comes into play. Because we provide the essential nutrients and items that they are looking for, women are going to be more inclined to buy our products. That being said, many women who consume Kashi products usually only know about the cereal or granola bars. So, we hope to raise awareness about the healthy pizza alternative that Kashi offers.

Geographic Strategy

Our research has shown us that both National and Spot advertising would be the most beneficial for the Kashi brand. With an extensive budget Kashi would want to sell to an American market that is considered overweight or obese. With huge markets like Los Angeles, New York, Chicago, and Washington D.C, it would be easy to let people know how beneficial it is for your body to eat healthier with Kashi Pizzas. The fattest cities in America include; Jacksonville, Florida, El Paso, Texas, Houston, Texas, Oklahoma City, Oklahoma, and Miami, Florida. Kashi will use spot advertising there to show how healthy their pizza is compared to the stereotypical “unhealthy” pizza.

Region Total Kashi Consumers (000) Females 25-54

New York, NY: 2647.5 4,575,307

Los Angeles, CA: 2014.6 3,779,054

Philadelphia, PA: 915.3 1,670,240

San Francisco-Oakland 876.4 1,501,749

San Jose, CA:

Atlanta, GA: 735.7 1,402,683

Washington D.C: 726.4 1,406,449

Boston, MA: 718.7 1,373,926

Houston, TX: 631.3 1,263,451

Detroit, MI: 625.9 1,089,635

Phoenix, AZ: 572.2 962,713

Primary Target Audience

In our campaign we would target college-educated women from ages 25-34. Single women make up not only the second largest sales in frozen pizza but also 22% of the total market. Since women make up only the second largest sales in frozen pizza it allows room for growth.

From a psychological viewpoint, single women in this age range are considered more likely to be health conscious. That being said, they are more likely to get themselves into a healthy routine and make wiser eating choices, therefore creating a healthier lifestyle.

Not only are women a good choice from a psychological standpoint, but they are also a good choice because of financial reasons. Since we are targeting a group of women that have a higher education, they are more likely to have a higher income than the average household. At the same respect, women in this age range usually have a family, which means extra expenditures.

Our women typically grocery shops at supermarkets like Whole Foods, Trader Joe’s, and Harris Teeters that potentially optimize their shopping trip. She is looking for foods that are nutritional and healthy, and not inexpensive or bargain shopping.

Our secondary group for this campaign would be gay men from the ages of 25-34. Gay men would be the secondary targets because studies have shown that both gay men and women of the same age group are able to precipitate messages in the same maner. These two groups not only share the same interests, but also are culturally integrated to be the same through society. Like our target audience, gay males are more likely to have a larger disposable income since they are less likely to have children to spend their money on. In addition, studies have shown that gay men are more responsive to advertisements and can influence women through non-judgmental ways.

Media Mix

Our company would spend $3.5 million dollars on advertising, which is a dramatically smaller amount of money compared to the average market; the reason being, our sales were so insignificant compared to our competitors. Financially we cannot compete with their advertising expenditures. If our rivals spend between $4 million and $35 million in advertising, then that would equal about 8 to 10% of the total sales of each company. If our company were going to use a tenth of our sales for advertising, it would leave us with 3.5 million dollars.

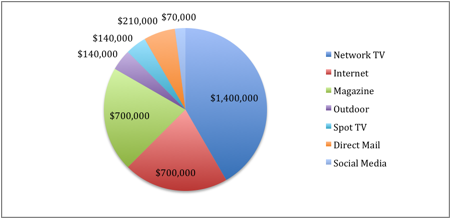

Our Advertising budget will be split between five mediums, Net TV, Spot TV, Internet, Outdoor, and Magazines, as well as direct mail and social media. According to studies, our target audience spends most of their time watching television compared to reading magazines or surfing the Internet. Because of these statistics, our consumers will be most affected by television advertisements. We will put 40% of our ads on network television since that is the most viewed medium. We will then put 20% of our ads on the Internet and in magazines for our audience to see, and 6% towards direct mail. Then we will take 8% of the remaining money for ads and put it towards outdoor and spot TV advertisements, and the other 2% towards social media efforts. By doing this, we will be able to increase sales over 15% and increase profits to over 40 million.

Timing/Scheduling

Our campaign will launch its advertising campaign starting August 1, 2012 and go until July 30, 2013. We will use a pulsing campaign so that there are continuous ads to remind consumers of the product. But, at peak purchasing months we will increase the ads to ensure our brand is recognized in the consumers’ minds. We will increase ads during the months when pizza is most likely to be eaten, which happens to be the summer months. Our ads will pulse May through August, October, and December.

Budget Breakdown

|

|

|

Net TV |

40% |

$1,400,000 |

Internet |

20% |

$700,00 |

Magazine |

20% |

$700,00 |

Outdoor |

4% |

$140,000 |

Spot TV |

4% |

$140,000 |

Direct Mail |

6% |

$210,000 |

Social Media |

2% |

$70,000 |

Creative Brief – Objectives

Strategy and Insight:

Pizza has never had the reputation of being a healthy choice option. Research has shown that pizza sales thrive due to ease and quickness when time constraints and tighter scheduling limit consumers. As more consumers opt for these choices, they are overlooking pizza as an option.

Challenges That We Face

The largest obstacle present is building brand awareness. Kashi must identify new markets and demographics, while also maintaining the current market. In doing so, we can simultaneously strengthen the brand identity and awareness that are pre-established within consumer loyalist.

Kashi is still relatively infant in the frozen pizza category, and has historically spent the majority of their advertising budget on the Internet medium. Using one medium limits the voice, opportunities, and potential consumer markets that create awareness and brand loyalty and are essential for growth and expansion.

Keep your eyes on the Prize

The primary focus is to bring Kashi to the forefront in the frozen pizza category as well as reminding women about how eating healthy can be as simple as ordering food.